It’s still unclear which way the housing market will move once the uncertainty of the election ends.

Historically, the housing market lulls in the leadup to general elections, according to the latest ‘State of the Nation’ report by TradeMe Property [TMP].

That election saw an increase in buyer activity the month before the election campaign and two months after the election – but a slight drop during election month.

There are some exceptions, though.

The 2020 election had minimal impact on the property market due to Covid-19 and unprecedented buyer demand throughout that year.

“Buyer activity tends to peak in spring, with the busiest month typically being October. With the general election happening this year, we expect the busiest period to shift to November,” the report said.

The report indicates a potential tsunami of houses flooding the market nationwide once the election is over – although this could depend on the government that is formed.

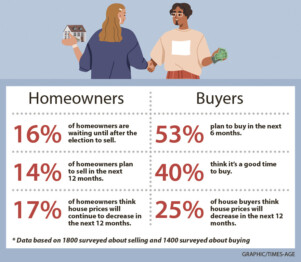

Of the homeowners surveyed by TMP, 16 per cent are waiting until after the election to sell, while 40 per cent of property seekers plan to buy in the next six months.

The election period has caused uncertainty around house prices, with 25 per cent of surveyed buyers believing they will decrease in the next 12 months, although that’s a significant drop from 47 per cent in the first quarter of this year

ANZ senior economist Miles Workman said it was expected the market would quieten down during the election period as “market participants wait to assess the mix of housing policies”.

He is anticipating only a “mild pick up in property prices” for the last quarter of 2023, despite forecasting another Official Cash Rate [OCR] hike come November that’s likely to push up mortgage rates.

Infometrics chief executive and principal economist Brad Olsen agrees November is likely to see the Reserve Bank lift the OCR again, although it’s “unlikely to be one final increase”.

Instead, Olsen thinks we may see several gradual OCR increases over time, with the first one coming in November.

“Inflation is moving in the right direction, interest rates appear to be at or near a peak,” Olsen said.

Prue Hamill, the managing director of Harcourts Masterton, doesn’t believe we’ll see a ‘tsunami’ but is optimistic that there’ll be an increase in properties coming to market.

Hamill believes that although there have been “numerous things that have gone on that have discouraged the property market”, the market will start to stabilise.

If the market is re-opened to international buyers, we may see a trickle-on effect from Wellington demand in Wairarapa, she said.

Bayleys realtor Andrew Smith also holds the view that our market is heavily “influenced by what happens in Wellington”, but he doesn’t expect to see many international buyers competing for family homes in Wairarapa.

It would need to be “a uniquely special property” for international buyers to come our way, he said.

Smith said it had been a slow autumn, but the first home buyers’ market has been “quite strong” and he expects this to continue, but whether we’re soon to see a buyer’s or a seller’s market remains unclear.

As the market ebbs and flows, a report from CoreLogic shows banks issued $5.8 billion of mortgages in August – 15.7 per cent more than in July and 6.8 per cent more than in August last year, but still 29 per cent below what it was when the property market was booming in August 2021.