Properties sold in the Masterton district made a median profit of $112,000. PHOTO/FILE

Region’s property sales rack up profits

BECKIE WILSON

beckie.wilson@age.co.nz

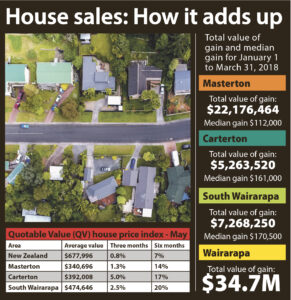

House-sellers across Wairarapa have made $34.7 million from 228 property sales during the first three months of this year.

The median profit for each property sold in the first quarter across the region ranged from $112,000 to $170,500, with profit defined as the difference between the purchase and the selling prices.

Nationwide, total profits for the quarter were $3.1b, according to the new figures from property analysts Corelogic.

Corelogic head of research Nick Goodall said significant growth in the region’s property market over the past two years had contributed to sellers making top dollar.

“This growth has mostly slowed down recently, but values are still increasing,” he said.

Nationwide figures showed that 96.2 per cent of sales in the first quarter were made at a price above the original purchase value, the report said.

Harcourts Wairarapa managing director Prue Hamill said the figures showed the market had truly recovered from the slump of 10 years ago.

With property, “it’s always a matter of time”, she said.

Properties sold in the Masterton district made a median profit of $112,000 [154 sales], with a total gain of $22.2m.

Properties sold in the Masterton district made a median profit of $112,000 [154 sales], with a total gain of $22.2m.

Those sold in Carterton made a median profit of $161,000 [34 sales], the highest for Carterton in 22 years, for a total gain of $5.3m.

But South Wairarapa topped the district with a median profit of $170,500 per property [40 sales], reaching a total of $7.3m.

Mr Goodall expects values and activity in the market to stabilise around the country.

“Demand for property is further impacted by tighter bank lending standards, slowing migration, and a more heavily scrutinised property investment market.”

This includes the ban on foreign buyers, and a change to the law meaning property investors must own a residential property for five years before sale, or pay tax on the proceeds, unless it is their main home or they had inherited it.

The cost of the healthy homes guarantee on landlords was also a factor. Mrs Hamill said the Corelogic report “spoke for itself” and gave a true reflection of the region’s market.

“When the market was down 10 years ago and we were declining, declining, declining and if you held on to [your home] and you’re selling it now, now we are back over those prices of 10 years ago,” she said.

The Wellington market had been crucial for Wairarapa’s market in terms of increased sales and demand.

“We have had a lovely trickle effect of people moving into our area and investing, that has really helped our market.”

While the region had taken some time to catch up with the main centres, Greytown had been “a very healthy market, price-wise” for some time, she said.

Mrs Hamill prefers a “tight” market, as it is now, because it helps with prices, demand, and decision-making from both buyers and sellers.

She agreed the market looked, in some ways, to be stabilising, and applauded Masterton District Council’s ‘My Masterton’ promotion which had benefited the area.

“We need to bring higher income people into the area, that is more cash flow, then businesses, our schools, and our employment do well.

“The more people we can bring here, the more skills in the labour force, all those things are important.”

The CoreLogic report shows that nationwide, total losses from re-sales, where sellers on-sold for less than their original purchase price, were $27.2m.

This is down from $36.6m the previous quarter, indicating that few people were concerned enough about the market outlook to push through quick sales for a lower price.